Regarding Social Security Disability, it’s vital to understand what types of income you need to report. Any financial contribution you receive could affect your benefits; hence, transparency is key.

This includes earned income from employment, self-employment, and other sources such as unemployment benefits, workers’ compensation, or any other form of assistance. This article aims to guide you through reporting income to Social Security Disability and to help you understand the effects of different types of income on your benefits.

Table of Contents

Two Disability Programs Administered By Social Security: SSD and SSDI

Social Security Disability (SSD)

Social Security Disability (SSD) is a program designed to provide financial aid to individuals who cannot work due to a disability. The importance of reporting income for SSD recipients must be balanced. Any income you earn can factor into your benefits – whether you maintain them, lose them, or have them reduced.

Impact of Income on SSD Benefits

Income impacts SSD benefits in several ways. Generally, if your earnings are high enough, they may be deemed ‘Substantial Gainful Activity’ (SGA), which could result in the loss of your benefits. This is because the SSD program is designed to assist those who cannot earn a significant income due to their disability.

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance (SSDI) is another program the Social Security Administration (SSA) administers. SSDI is meant for individuals who have paid into the Social Security system through their taxes but can now work because of a disability.

As with SSD, SSDI beneficiaries must report all income to avoid penalties and ensure the appropriate calculation of their benefits.

Impact of Income on SSDI Benefits

The income reported by SSDI beneficiaries can also affect their benefits. Any income that exceeds the SGA limit may result in the termination or reduction of their SSDI benefits.

Additionally, certain types of unearned income, such as income from investments, might not affect SSDI benefits, while other types, including public disability benefits or pensions, can potentially reduce them.

Reporting Requirements

Overview of the Reporting Process for Income to Social Security Disability

Reporting income to Social Security Disability, whether SSD or SSDI, is a straightforward process that requires full disclosure of all earned and unearned income. This includes wages from jobs and income from self-employment, unemployment benefits, workers’ compensation, and any other forms of assistance.

The Social Security Administration (SSA) provides multiple ways to report this income online, by mail, or over the phone. It’s crucial to provide dated and signed copies of all pay stubs or other proof of income to ensure an accurate report.

The Importance of Accurate and Timely Reporting

Accurate and timely income reporting is crucial to maintaining your benefits and avoiding penalties. The SSA needs to have the most recent information about your income to make appropriate decisions regarding your benefits.

Timely reporting allows the SSA to adjust your benefits as your income changes, keeping you on the right side of the law and guaranteeing that you receive the correct benefits.

Consequences of Not Reporting Income

Failing to report income can have serious consequences. If the SSA discovers that you have yet to report your income accurately, you may be required to pay back the benefits you were not entitled to.

This could result in a loss of benefits, severe fines, or even legal action. In the worst-case scenario, it could be considered fraud, leading to criminal charges. It’s, therefore, crucial to report all income promptly and accurately to avoid these potential repercussions.

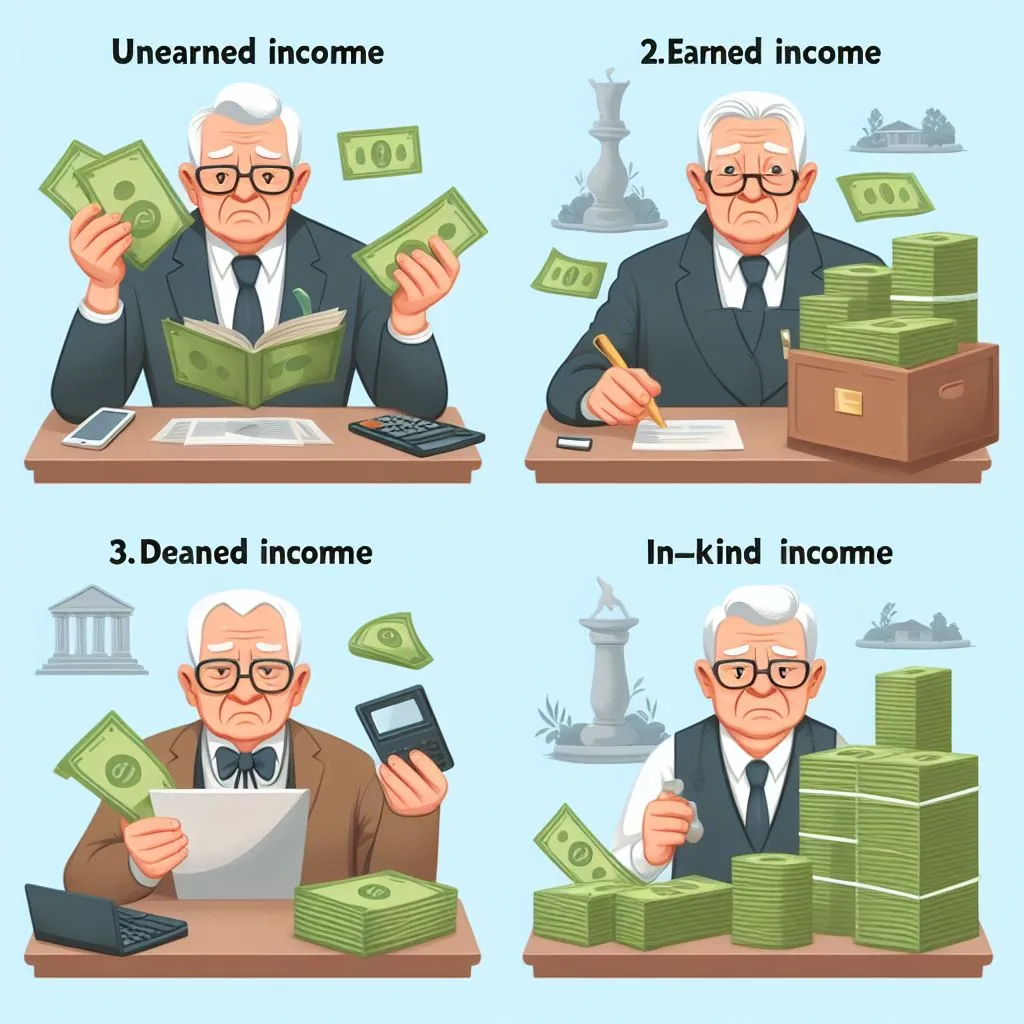

Four Types of Income

Unearned Income

Unearned income refers to any revenue that does not come from employment or business activity. This could include income from investments, rental properties, alimony, retirement pensions, and other benefits.

This income must be reported to the SSA as it can impact your SSD or SSDI benefits depending on its nature and amount. However, it’s important to note that certain forms of unearned income, like inheritances, gifts, or life insurance payments, are not counted towards the SGA limit.

Earned Income

Earned income is any income derived from work or self-employment, including wages, salaries, bonuses, and profits from a business you own. This is the most common type of income that can affect your benefits.

If your earnings are high enough, they may be considered ‘Substantial Gainful Activity’ (SGA) and could lead to the reduction or termination of your benefits. Even part-time or temporary work must be reported to the SSA.

Deemed Income

Deemed income is a little more complex. It refers to the portion of income from your spouse, parent, or parent’s spouse that the SSA ‘deems’ available to you. It also includes the value of food or shelter someone else provides.

This income may also impact your SSD or SSDI benefits and must be reported to the SSA.

In-kind Income

In-kind income refers to food or shelter you receive for free or less than its fair market value. Examples include free rent or subsidized housing. As with the other types of income, in-kind income must be reported to SSA as it can affect your benefits.

Note, however, that not all in-kind income counts for SGA purposes, and it’s essential to clarify this with the SSA or a knowledgeable advisor. Accurately reporting this type of income is critical as the SSA can reduce your benefits based on its value.

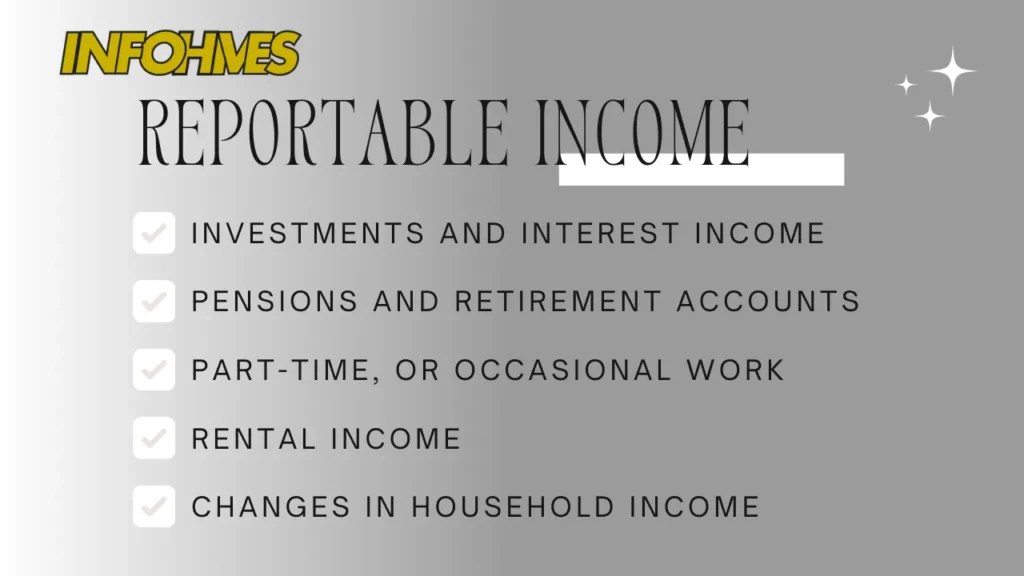

Reportable Income

A variety of diverse income sources must be reported to the SSA to maintain an accurate record for SSD or SSDI benefits calculation. In addition to the four main types of income previously discussed (Unearned, Earned, Deemed, and In-kind), there are a few other types to be aware of.

You must also report any changes in your living arrangement as they may impact your benefits. For instance, changes in household income, such as a roommate moving in or out or changes in marital status, can affect your benefits. Furthermore, any income from pensions or retirement accounts that you receive should also be reported.

Even income from occasional work or odd jobs, like yard work or babysitting, should be reported to the SSA.

Examples of Reportable Income

- Investments and Interest Income: Any income generated from investments, including dividends, interest, or capital gains, should be reported. For example, if you have a savings account earning interest, that interest is considered income.

- Pensions and Retirement Accounts: If you receive monthly payments from a pension or withdrawals from a retirement account, this is also considered income. For example, 401(k) or IRA payments should be reported.

- Temporary, Part-Time, or Occasional Work: Even income from sporadic work should be reported. For instance, if you earn money from a temporary holiday job, that income should be reported to the SSA.

- Rental Income: This income should be reported if you own a property and receive rent from tenants.

- Changes in Living Arrangements or Marital Status: Any changes in your household income or marital status might affect your benefits and should

Exempt Income

Exempt income encompasses various forms that don’t need to be reported to the SSA because they don’t count towards the SGA (Substantial Gainful Activity) limit. Some examples of exempt income include certain life insurance payments, inheritance, or gifts.

Moreover, income from specific public benefit programs, like the Supplemental Nutrition Assistance Program (SNAP) or housing assistance from the Department of Housing and Urban Development (HUD), is typically exempt.

It’s essential to verify the exempt status of any income with the SSA or a knowledgeable advisor to ensure you’re not over-reporting your income.

Examples of Exemptions and Exclusions

- Inheritance and Gifts: Money or property you inherit or receive as a gift is typically not counted as income for SSD or SSDI purposes. For instance, if a relative leaves you a cash inheritance, this would generally not be considered income.

- Life Insurance Payments: Certain life insurance payments are also exempt from income. For example, receiving a death benefit from a life insurance policy would not be considered income.

- Assistance from Government Programs: Many forms of public assistance do not count as income. This includes SNAP (food stamps), HUD housing assistance, or heating assistance through the Low-Income Home Energy Assistance Program (LIHEAP).

- Medical Care and Services: The value of medical care or services you receive, including Medicaid, is exempt from income.

- Educational Assistance: Scholarships, grants, and fellowships for tuition and educational fees are typically exempt from income. However, portions used for room and board may be counted as income.

It’s essential to note that while these types of income commonly fall into the exempt category, each person’s situation is unique. Always consult the SSA or a knowledgeable advisor for guidance on your circumstances.

How Reported Income Affects the Calculation of SSD and SSDI Benefits

The Social Security Administration (SSA) considers your reported income when calculating your SSD or SSDI benefits. Generally, the more income you have, the less you may receive benefits. This is because the SSA evaluates your income to determine if you are engaging in Substantial Gainful Activity (SGA).

You might become ineligible for benefits if your income surpasses the established SGA threshold. However, certain types of income, such as deemed and in-kind, can also impact your benefits by causing a reduction in the amount you receive, even if they don’t count towards SGA.

Therefore, it’s crucial to accurately report all types of income to prevent unexpected benefits changes.

Reporting Process and Tips

Reporting income to the Social Security Administration is crucial in maintaining your SSD or SSDI benefits. Here’s a step-by-step guide on how to do so:

- Gather Necessary Documents: Collect all the necessary documents that detail your income. This includes pay stubs, tax documents, bank statements, or other income proof.

- Contact the Social Security Administration: Call the SSA at 1-800-772-1213 (TTY 1-800-325-0778) between 8:00 am and 7:00 pm, Monday through Friday.

- Provide Your Information: The SSA representative will ask for your details, including your Social Security number and proof of income. Be ready to provide this information.

- Report Your Income: Clearly and accurately report your income to the representative.

- Keep a Record: Always record your reported income and the details of your call for future reference. You can request a receipt from the SSA.

Online Reporting Options and Other Methods Available

In addition to the traditional phone method, there are several other ways to report your income to the SSA.

- Online: The Social Security Administration offers an online system where you can report your wages directly. Visit the SSA website, log into your account, and follow the instructions for wage reporting.

- Mobile App: The SSA has a mobile wage reporting application that allows SSD and SSI recipients to report their wages. The app is available for both iOS and Android devices.

- Mail: You can mail your wage report to your local Social Security office. Include your Social Security number and the month the wages apply to.

- In-person: You can also report your income by visiting your local Social Security office. Call ahead and schedule an appointment to save time.

Remember, reporting your income accurately and promptly can help prevent overpayments and ensure you receive the correct benefits. Always consult a knowledgeable advisor if you need clarification or assistance on the reporting process.

Eligibility Without Work History

- Understanding the Basics

Eligibility for SSD or SSDI benefits typically relies on a work history that demonstrates you have paid into the Social Security system over a certain period. However, even without a qualifying work history, you might still be eligible for disability benefits under the Supplemental Security Income (SSI) program.

SSI is a needs-based program for individuals with limited income and resources, and it doesn’t require recipients to have a previous work history. Your eligibility for SSI depends on your financial need, age, disability status, and other factors. It’s essential to consult with an advisor or the SSA for guidance on your eligibility.

- Necessary Documentation and Process

To apply for SSI benefits, you must provide documentation demonstrating your financial situation and disability status. This includes bank statements, medical records, proof of residence, and income records.

The application process can be initiated online, by phone, or in person at a local SSA office. It’s advisable to consult with an expert or use available SSA resources to navigate the application process accurately and efficiently.

Trial Work Periods and Reporting Income

- Understanding Trial Work Periods

The SSA offers a Trial Work Period (TWP) to SSD/SSDI recipients to encourage them to attempt work without fear of losing their benefits. During the TWP, which consists of nine months within a rolling 60-month period, you can earn unlimited income without affecting your benefits.

The TWP serves as a safety net, allowing you to test your ability to work while still securing your benefits.

- Reporting Income during Trial Work Periods

During a TWP, you must report your income to the SSA to avoid overpayments and potential penalties. The reporting process is the same as the general income reporting process.

Whether using the online system, the mobile app, mail, or in-person method, you can provide accurate information about your income and record your reported income. Honesty and transparency in wage reporting during a TWP are vital to maintaining your SSD or SSDI benefits.

- Post-Trial Work Periods

Following the TWP, if you continue to work and your earnings are above the SGA threshold, there’s a three-month grace period where you’ll continue to receive full benefits.

After this, your benefits may cease, but the SSA provides ‘expedited reinstatement’ for five years, allowing you to request immediate reinstatement if you cannot continue working due to your disability.

This framework aims to support disability recipients in their attempt to re-enter the workforce while providing a safety net of benefits.

Conclusion

Navigating Social Security Disability (SSD) requires a clear understanding of income reporting. Earned and unearned income, essential for SSD and Social Security Disability Insurance (SSDI), impact benefits. Reporting demands accuracy and transparency, whether online, via phone, or in person.

The consequences of inaccurate reporting include benefit loss, fines, or legal action. Special attention is required during Trial Work Periods (TWPs) to ensure honest income disclosure. Exemptions exist, such as inheritances or public assistance, but clarity is vital.

Timely and accurate reporting guarantees benefits align with your circumstances. Empower yourself with the knowledge to uphold eligibility and secure your rightful SSD or SSDI benefits.

Frequently Asked Questions

How do I report income for SSD?

You can report your income to Social Security Disability (SSD) in several ways: via phone by calling the SSA at 1-800-772-1213; online through the SSA website; using the SSA mobile wage reporting app; by mail; or in person at your local Social Security office. You will need to provide your Social Security number and proof of income.

What documents do I need to report income for SSD?

When reporting income for SSD, you’ll need documents that detail your income, such as pay stubs, tax documents, bank statements, or any other proof of income.

Do I need to report my income during a Trial Work Period (TWP)

Yes, reporting your income to the SSA during a TWP is crucial to avoid overpayments and potential penalties. You can earn unlimited income without affecting your benefits during the TWP, but accurate reporting is necessary.

What happens if I don’t report my income accurately to the SSA?

Not accurately reporting your income can lead to overpayments, and you may be required to repay the excess to the SSA. Consistently under-reporting income can also lead to penalties or loss of benefits.

Can I use the online system or mobile app to report my income if I participate in the TWP?

You can use the online system or the SSA mobile wage reporting app to report your income during a TWP. These methods provide an easy and convenient way to report your wages accurately.

What happens after my TWP ends?

After the TWP ends, if you continue to work and your earnings exceed the Substantial Gainful Activity (SGA) threshold, you’ll still receive full benefits for a three-month grace period. After this, your benefits may cease, but you can request immediate reinstatement of benefits for up to five years if you cannot continue working due to your disability.