What is a Class 3 Firearms License?

A Class 3 Firearms License, also referred to as a Class 3 Federal Firearms License (FFL) grants the holder permission to sell items regulated under the National Firearms Act (NFA). These items include suppressors, barrel rifles shotguns machine guns, destructive devices, and other similar weapons. This license falls under a tax category that enables the licensee to carry out activities, beyond what is allowed with a regular license.

What are the Requirements for a Class 3 FFL License?

To obtain a Class 3 FFL License, several requirements must be met:

U.S. Citizenship or Permanent Residency

Applicants must be a U.S. citizens or have permanent residency status in the United States.

Age

Applicants must be at least 21 years of age.

Compliance with Federal, State, and Local Law

Applicants must comply with all federal, state, and local laws regarding the possession and sale of firearms. Any violation of these laws can result in the denial of an application.

Premises for Conducting Business

Those applying for a Class 3 FFL License must have a physical location where they intend to conduct business. This can be a commercial storefront, a home-based business, or any other premises that meet the zoning requirements.

Background Check

An integral part of the application process is the background check. Applicants must not have any felony convictions and must not have violated any firearms laws in the past.

Payment of Special Occupational Tax

Class 3 FFL license holders must pay a yearly Special Occupational Tax, which varies based on the size and type of business.

Meeting all these requirements does not automatically guarantee the issuance of a Class 3 FFL license as the final decision rests with the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

Step 1 – Obtaining a Federal Firearms License

Get ATF Form 5310.12

The ATF Form 5310.12 which is commonly referred to as the “Application, for Federal Firearms License (FFL)” serves as the step in acquiring a Class 3 FFL. This official document is required by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) for individuals applying for an FFL. The form asks for details about the applicant, their business, and their intended activities related to firearms.

When completing the form ensure that you provide all information accurately and thoroughly in the fields. It’s important to be mindful of offering correct information to facilitate an application process. Please note that providing statements, on this form is an offense and can lead to punishment; therefore accuracy is of utmost importance.

Get Complete ATF Form 5330.20

ATF Form 5330.20 also referred to as the “Certification of Compliance, with 18 U.S.C. 922(g)(5)(B)” holds importance during the application process for a Class 3 FFL. This form acts as a certification confirming adherence to U.S. Legislation in relation, to the limitations imposed on immigrant aliens.

This form must be completed by any applicant who is not a U.S. citizen. It’s crucial to remember that any knowingly false statements on this form can lead to penalties under U.S. law, so ensure the information provided is accurate and truthful.

Get FD-258 cards

The FD-258 card is also known as the “Fingerprint Identification Card”.This card is used to conduct a thorough background check on the applicant. FBI uses the fingerprints provided on this card to verify the applicant’s criminal record history. Accurate and clear fingerprints are required for the successful processing of your application.

Submit two 2”x2” photos for each responsible person

As part of the application process, you must provide two recent 2”x2” photographs of each responsible person listed in your application.

The photos should be clear, and front-facing, and must show the full face of the individual. Do not wear hats or sunglasses in the photo. These photos are used to verify the identity of the responsible persons involved in your business.

Interview with an Industry Operations Investigator

Once you’ve submitted your application you can expect to have an interview scheduled with an Industry Operations Investigator (IOI) from the ATF. This interview is a step, in the application process.

During the interview, the IOI will verify the information you provided in your application conduct an inspection of your business premises and ensure that you have an understanding of all state and local laws regarding firearms handling and sales.

Additionally, this interview presents an opportunity for you to ask any questions or seek clarification, about operating under a Class 3 FFL.

Wait approximately sixty days

After you’ve submitted your application and completed the interview the ATF will start processing your application. The processing time usually lasts around sixty days. It may differ based on the number of applications they’re handling and the complexity of your application.

While you wait it’s crucial to adhere to all state and local firearms laws. Following these guidelines will help facilitate a processing period and improve your chances of an application.

Step 2 – Obtaining a Class 3 Special Occupational Tax

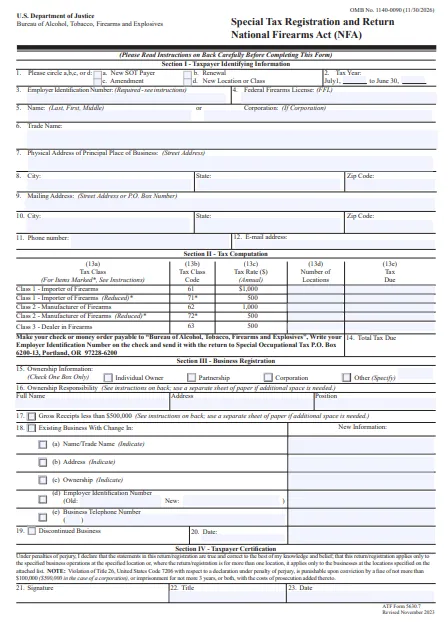

Complete ATF Form 5630.7

The ATF Form 5630.7 which is also called the “Special Tax Registration and Return National Firearms Act (NFA) ” is a document that you need to complete to apply for the Special Occupational Tax. This form is necessary, for registering your business under the National Firearms Act and making the required payment for the Special Occupational Tax.

The form requires information, about you as an applicant, your business, and any firearms-related activities associated with it. It’s important to provide details since providing information can result in penalties according to U.S. Law.

Submit the $500 annual fee along with the completed form

After Filling ATF Form 5630.7, you will need to submit a $500 annual fee along with it. This fee can be paid through check, money order, or electronic fund transfer payable to the Bureau of Alcohol, Tobacco, Firearms, and Explosives.

Make sure to attach the payment proof along with the form when submitting. Remember, the form and fee must be submitted together for the application to be considered complete.

Resubmit by July 1st of each year

The Special Occupational Tax and the associated ATF Form 5630.7 need to be resubmitted by July 1st of each year. Renewal costs are the same $500 as the initial application.

The renewal process is similar to the original application process. It involves completing the ATF Form 5630.7 and submitting it with the payment proof. It’s important to remember that late renewals may result in a lapse of your license.

Basics of NFA Firearms

The National Firearms Act (NFA) enacted in 1934, governs the sale, use, and possession of certain types of firearms and accessories in the U.S. This section provides a comprehensive understanding of the fundamental aspects of NFA firearms.

- Types of NFA/Class 3/Title II Weapons Firearms

NFA firearms, also known as Title II weapons, encompass a broad range of firearms and accessories. They include machine guns, short-barreled rifles (SBRs), short-barreled shotguns (SBSs), suppressors (also known as silencers), destructive devices, and any other weapons (AOWs), which is a catch-all category for certain unusual types of firearms.

- Registration and Transfer of NFA Firearms

- Obtaining an NFA Firearm

- Restrictions on NFA Firearms

- Penalties for Non-Compliance

NFA Activity per Class of SOT

Class 1: Importers of NFA Firearms

Class 1 Special Occupational Tax (SOT) holders are licensed to import NFA firearms. This includes bringing NFA firearms from outside the U.S. into the country for distribution.

They’re required to comply with all laws and regulations related to the import process, including completing necessary documentation and ensuring that imported firearms meet U.S safety standards.

Class 2: Manufacturers of NFA Firearms

Class 2 SOTs are licensed to manufacture NFA firearms. This class allows entities to produce various types of NFA firearms, such as short-barreled rifles, machine guns, and silencers.

Manufacturers must maintain accurate records of production and ensure that each firearm produced is registered and meets the specification standards set by the ATF.

Class 3: Dealers of NFA Firearms

Class 3 SOTs are licensed to deal in NFA firearms, which involves the sale and transfer of these firearms to individuals and entities.

Dealers must conduct thorough background checks on potential buyers, maintain accurate records of each sale, and ensure the proper transfer procedures are followed.

Each class of SOT has its own set of responsibilities and regulations. Maintaining strict adherence to these guidelines is crucial not only for legal operation but also for ensuring the safety and security of the community. Missteps can lead to severe penalties, including fines, imprisonment, and loss of licensure.

The Gun Control Act (GCA)

The Gun Control Act (GCA) of 1968 is a U.S. federal law that regulates the firearms industry and firearm owners. It primarily focuses on commerce and prohibits interstate firearms transfers except among licensed manufacturers, dealers, and importers.

The GCA imposes age restrictions on the purchase of firearms, forbids the sale of firearms to certain categories of individuals (such as convicted felons or mentally unstable persons), and mandates that all manufactured or imported guns have serial numbers.

The GCA works in conjunction with the National Firearms Act to form the foundation of Federal firearms law. It’s an essential element for anyone dealing with firearms to understand, as adherence to its guidelines is critical to maintaining legal operation and avoiding penalties.

FFL License Type, SOT Class, and SOT Cost

In the United States, a Federal Firearms License (FFL) is a license that enables an individual or a company to engage in a business on the manufacture or importation of firearms and ammunition, or the interstate and intrastate sale of firearms.

There are several types of FFL, each designated for specific activities in the firearms and ammunition industry. Here’s a brief overview:

FFL License Types

- Type 01 FFL: Dealer in Firearms Other Than Destructive Devices – This is for businesses engaged in the sale of firearms to the general public. It’s the most common type of FFL for gun shops.

- Type 02 FFL: Pawnbroker in Firearms Other Than Destructive Devices – Similar to Type 01, but specifically for pawnbrokers.

- Type 03 FFL: Collector of Curios and Relics – For collectors of antique firearms. It’s not intended for businesses engaged in firearms sales.

- Type 06 FFL: Manufacturer of Ammunition for Firearms Other Than Ammunition for Destructive Devices or Armor Piercing Ammunition – This is for businesses that manufacture ammunition, except for armor-piercing types.

- Type 07 FFL: Manufacturer of Firearms Other Than Destructive Devices – This license is for businesses that manufacture firearms, including gunsmiths.

- Type 08 FFL: Importer of Firearms Other Than Destructive Devices – For businesses importing firearms and ammunition.

- Type 09, 10, and 11 FFLs: These are for dealers, manufacturers, and importers of destructive devices, respectively.

Regarding the Special Occupational Taxpayer (SOT) classes and costs:

- SOT Class 1: This is for importers of NFA (National Firearms Act) firearms. It allows the importation of NFA firearms, subject to compliance with the NFA rules and regulations.

- SOT Class 2: This class is for manufacturers of NFA firearms. It allows for the manufacture and dealing of NFA firearms.

- SOT Class 3: This class is for dealers of NFA firearms. It allows the dealer to sell and transfer NFA firearms to the public and other FFL holders.

The cost of SOT varies depending on the class and the business revenue. As of my last update in April 2023, the annual SOT fee was $500 for most businesses, but it could be lower for smaller businesses with less gross income.

It’s important to note that these fees and regulations can change, so it’s always a good idea to consult the latest information from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) or a legal expert in firearms law.

Final Thoughts

Understanding the intricacies of the National Firearms Act (NFA), the Gun Control Act (GCA), and the roles of different SOT classes is essential for individuals and businesses dealing with firearms. Rigorous compliance with the regulations set forth by these acts ensures the legal operation of your business and the fostering of a safer community.

Whether you’re an importer, manufacturer, or dealer of NFA firearms, staying informed about the current laws, and maintaining up-to-date licensing is crucial. It’s also important to remember that these regulations can change, and staying informed about any updates or changes is part of your responsibility as a Federal Firearms License holder.